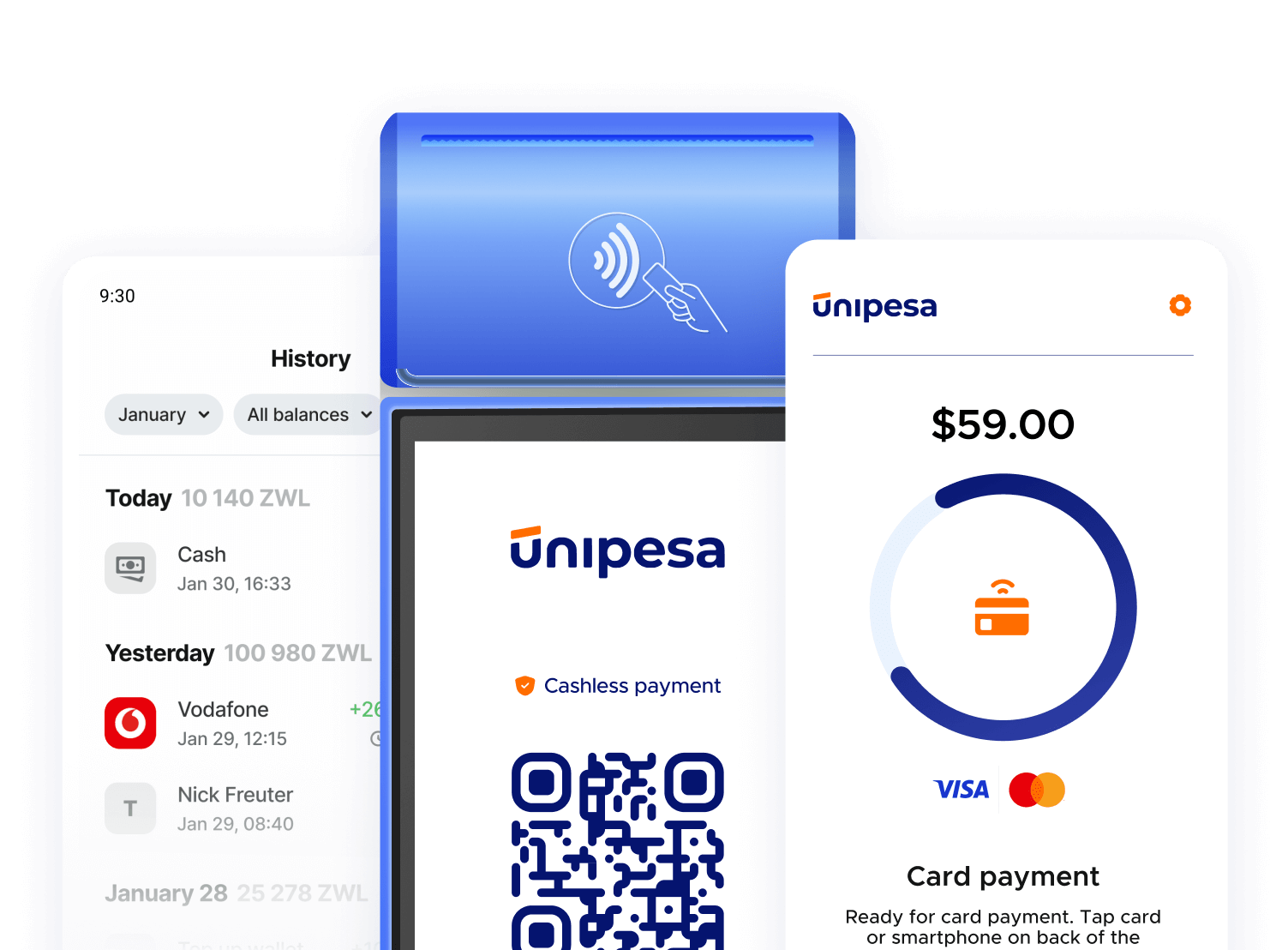

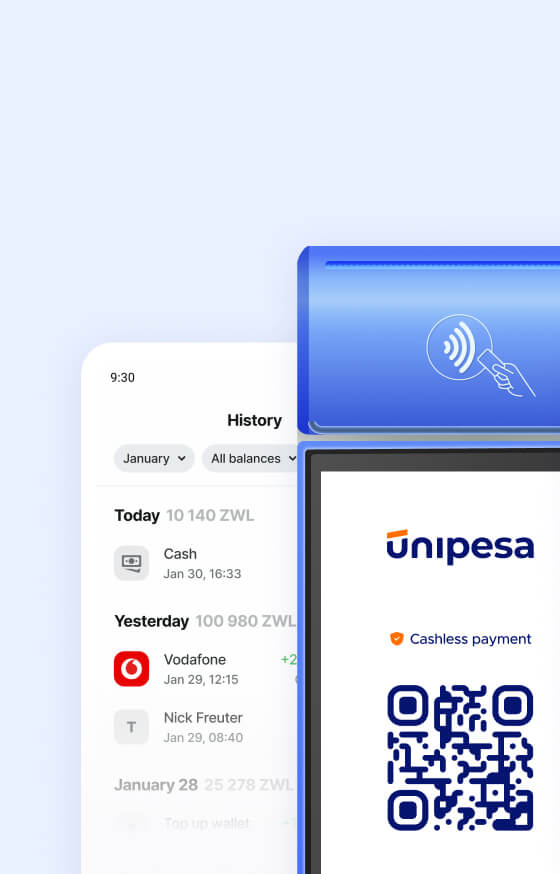

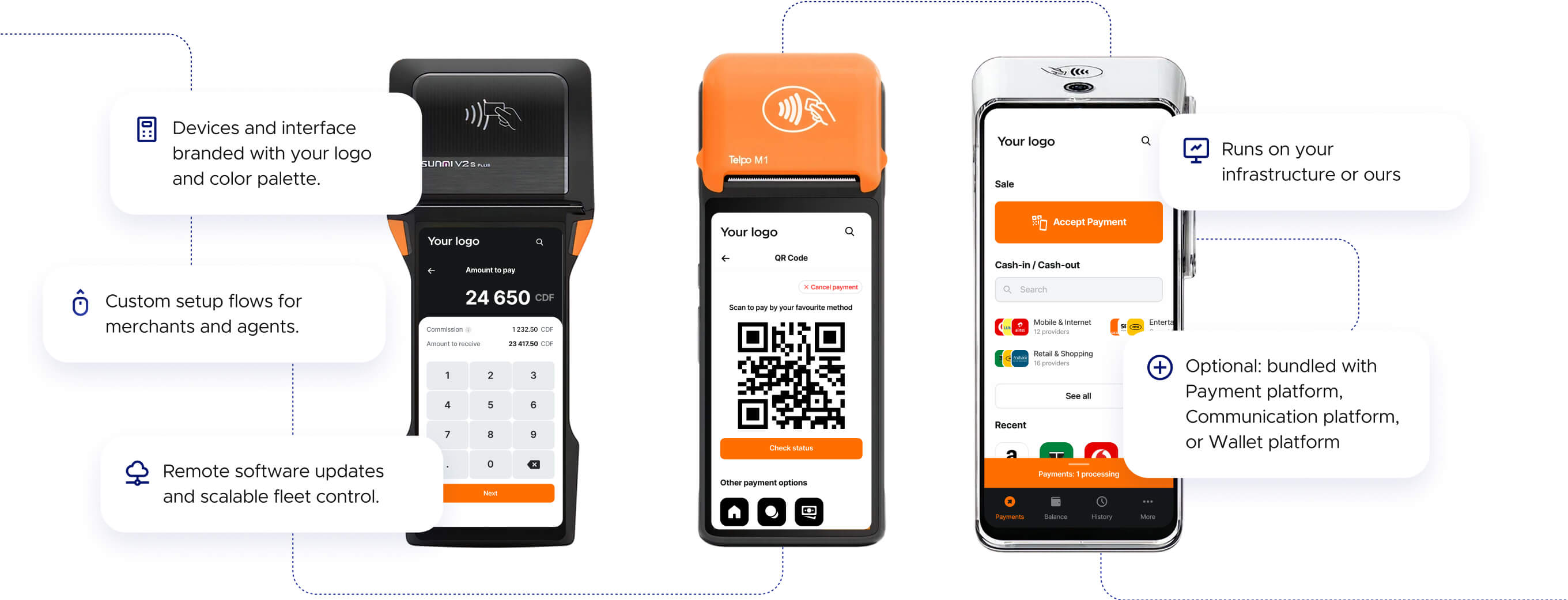

Point of sales platform

One application to handle cash, bills, and cashless payments for agents, retailers, bank agency. One platform to grow your POS network.

Build a network of digital point of sales.

Core Infrastructure

- Smart API routing and microservices architecture

- PCI DSS and ISO / IEC 27001 compliant infrastructure

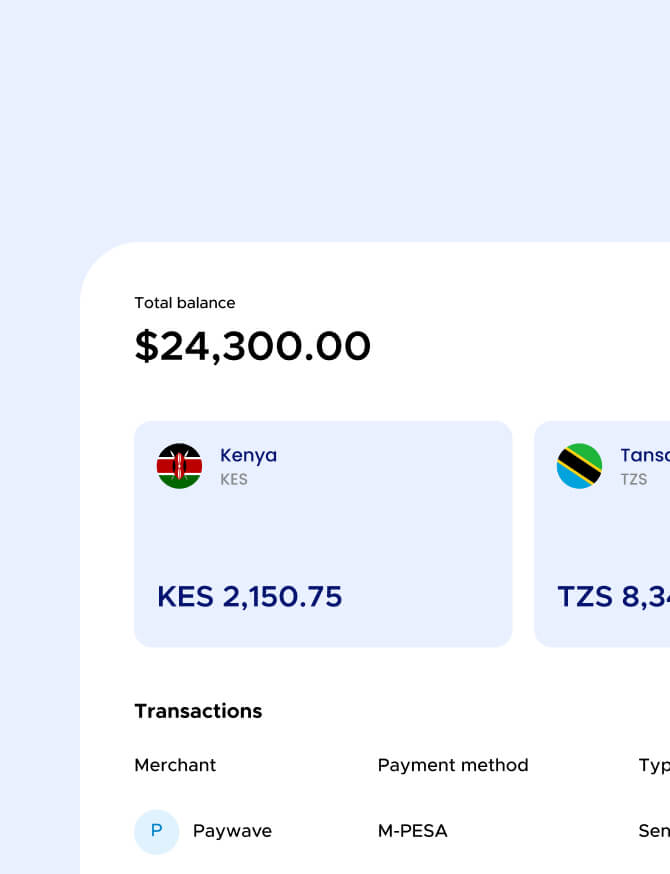

- Multi-currency and multi-market ready

- Embedded finance and bulk payouts

Control and transparency

- Enterprise-grade back office and access control

- Transparent analytics and transaction visibility

- Built-in AI fraud detection and risk engine

- Role-based access and audit logging

Business operations

- Real-time payments and reconciliation

- Billing-ready for marketplaces, payroll use cases

- Money collection, payouts, and balance tracking

- Invoicing, salaries, and business logic automation

We rolled out 200+ devices across 4 countries in under two weeks — fully branded and integrated. Game changer

Retail expansion lead

Fintech aggregator (Ghana)

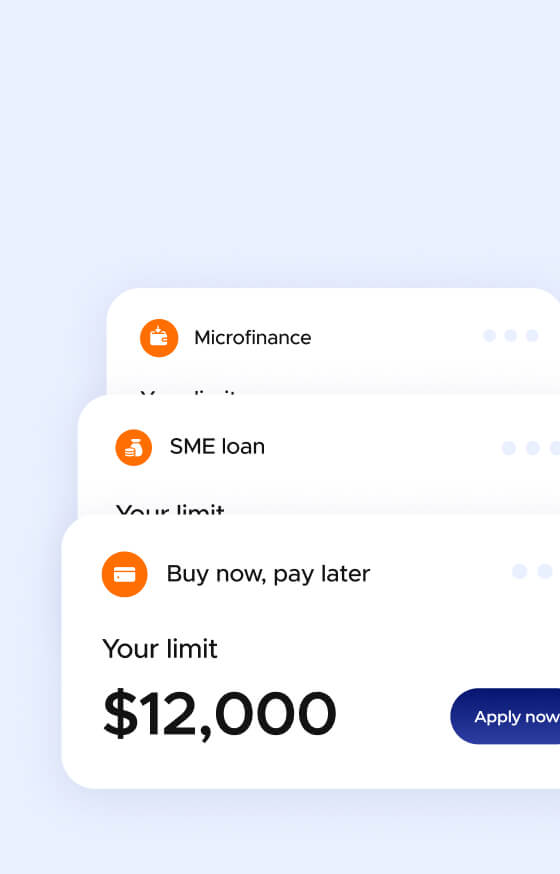

Supported payment types and features.

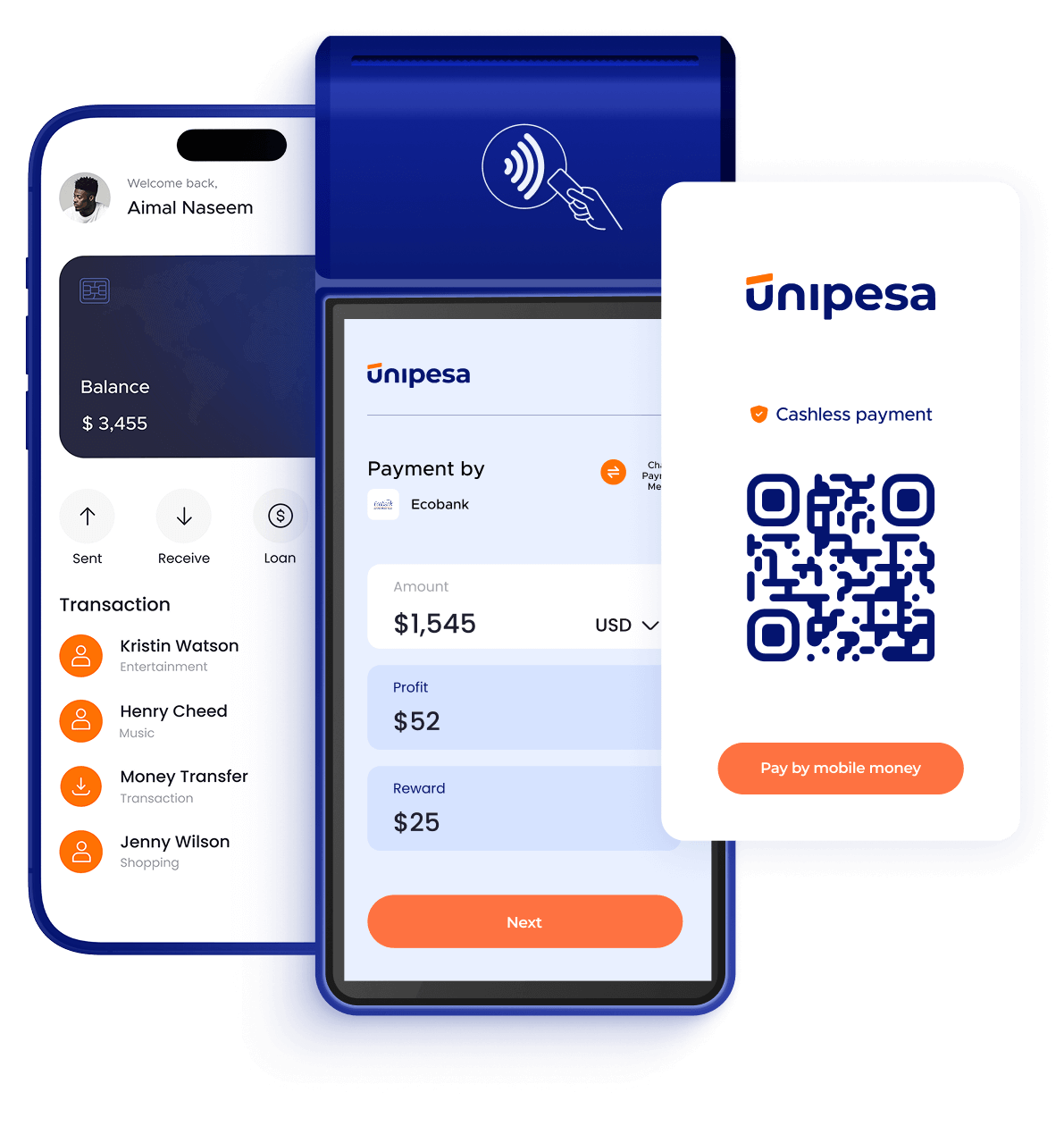

Contactless cards and chip cards

Cash acceptance and disbursement

QR payments

Promt Payments via Mobile Money

Subagent network

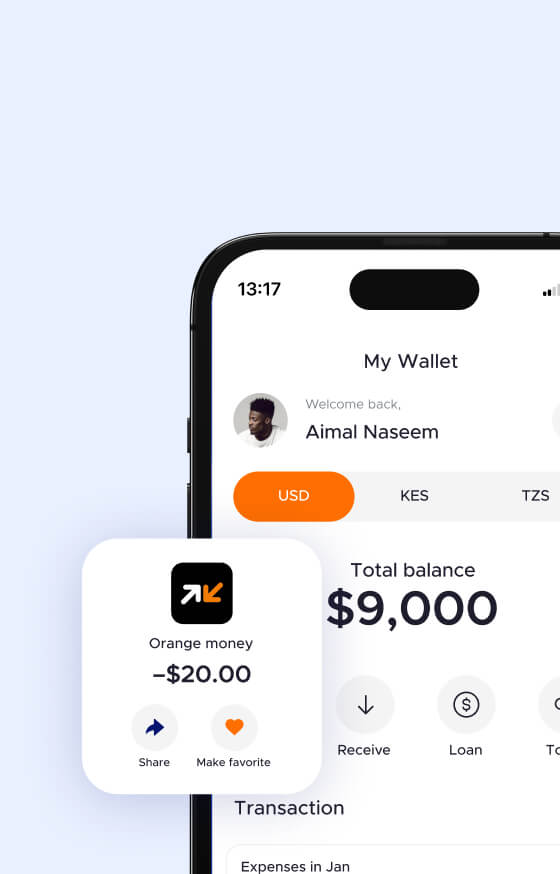

Single float balance

One device — multiple roles

Agents with utility payments

- Cash in, cash out

- Bill payments to utility providers

- One android based smartphone

- Single balance with one float for all providers and telco

Retailer with sales

- QR cashless payments

- Promt payments via Mobile Money

- Bank cards NFC cashless payments,

Hybrid agents and retailer

- Utility payments

- Accept cashless payments

- Single balance — no float needed, you just use what you’ve collected.

Subagent network

Each Payment Agent may develop its own agents network. Agent may register Subagents and manage the commissions for them. Agent supports them in business setup, POS maintenance, Balance distribution, Backoffice set up. Subagents give him an additional payment volume and rewards. Win-win partnership.

Telco / Service provider

Agent

Agent – is an independent entrepreneur, who gets Partner's Smart POS and starts searching for Customers on his own. Agent signs contract with Partner to start operating. Agent doesn’t get salary from Partner, but only % reward based on payments he managed to arrange.

Agent network

Agent network – is an Agent or a Company, which hires subagents to manage payments. Subagents can get either % reward, or fixed salaries from Agent network. Agent network signs contract with Partner. Agent network signs contracts with Subagents. Agent network and subagents use Partner’s Smart POS for payments. Subagents and agents earn commissions from Service providers.

* Partner becomes a Telco / Service provider agent contract with Telco and gets rewards directly from Telco. Partner doesn’t have employees-cashiers, who act as Agents, but searches for independent Agents or Agent networks and provides Smart POS solution to them.

POS use cases: from agency

banking to utility payments

-

Electricity, water, airtime, internet

-

Crypto top-ups & remittance flows

-

Government services and tax collection

-

Ticketing, betting, e-commerce checkout

-

Loan and credit card repayments

-

Any merchant, any channel

White-label POS. Fully yours.

Build your own POS business — under your brand. Unipesa POS platform is built for modern retail, agency banking, telcos, and financial services providers operating across Africa. Accept payments, issue withdrawals, manage inventory, and process QR or card transactions — all in one flexible solution.

How does it work

1. Platform Integration

The partner provides Logos for branding. Sign the contract

2. Service Providers integration

The partner contracts service providers and telcos. Unipesa handles technical integration.

3. Agent & merchant onboarding

The partner recruits agents, merchants, or retail outlets to join the network.

4. Make profit

Agents / Retailers start processing payments locally and regionally and pay fees per transaction.

Security, compliance, and support

EMV-certified

terminals only

PCI DSS compliant (Certificate ECM-20-64A1/CC-276)

24/7 tech support and remote diagnostics.

Instant problem resolution via admin dashboard

Tokenization and fraud filters on every transaction

Digitized payment agents

The table shows the benefits of a digital POS solution for agents.

Digital agent

Easy setup and KYC with all needed support from Partner’s team

Keep one balance above zero

Only one device needed

Make payments to all connected to partner specific merchants and service providers, including global merchants

User friendly, one backoffice personal area with all the statistics and payments management

Ability to develop its own agents network increasing the payments volumes

Use your own smartphone for payments. No need to buy and hold separate POS terminal

Traditional model

Complicated procedures, documents list, approval stage

Keep separated balances in each Telco and Provider above zero

Separate device for each Telco

Make payments only to main providers connected to Telcos

Poor UI or missing totally the backoffice personal area. Separated personal areas

Agents can not develop agents networks

Separate devices with USSD commands

Pricing aligned with your growth. Simple, fair, and transparent.

We don’t charge per API call or force you into long-term licenses. You pay once to launch — and we earn when you do, through simple revenue sharing. We handle the heavy lifting.

Talk to salesLet’s build something together

We’ll walk you through the platform, answer your questions, and show you how fast you can launch with Unipesa.