Banks and MFIs

For banks and microfinance institutions across Africa, building digital infrastructure from scratch is costly and slow. Unipesa helps launch wallet, lending, and onboarding flows in weeks — with full compliance and zero internal dev effort

Challenges for banks and MFIs in Africa

-

High CAPEX and long implementation cycles for digital services.

-

Regulatory complexity around KYC, onboarding, and data handling.

-

Limited scalability of in-house lending and repayment systems.

-

Lack of flexible wallet infrastructure for new customer segments.

-

Operational overhead for support, fraud, and reconciliation.

-

Limited branch coverage makes banking services hard to access.

Solution: go digital without building from scratch.

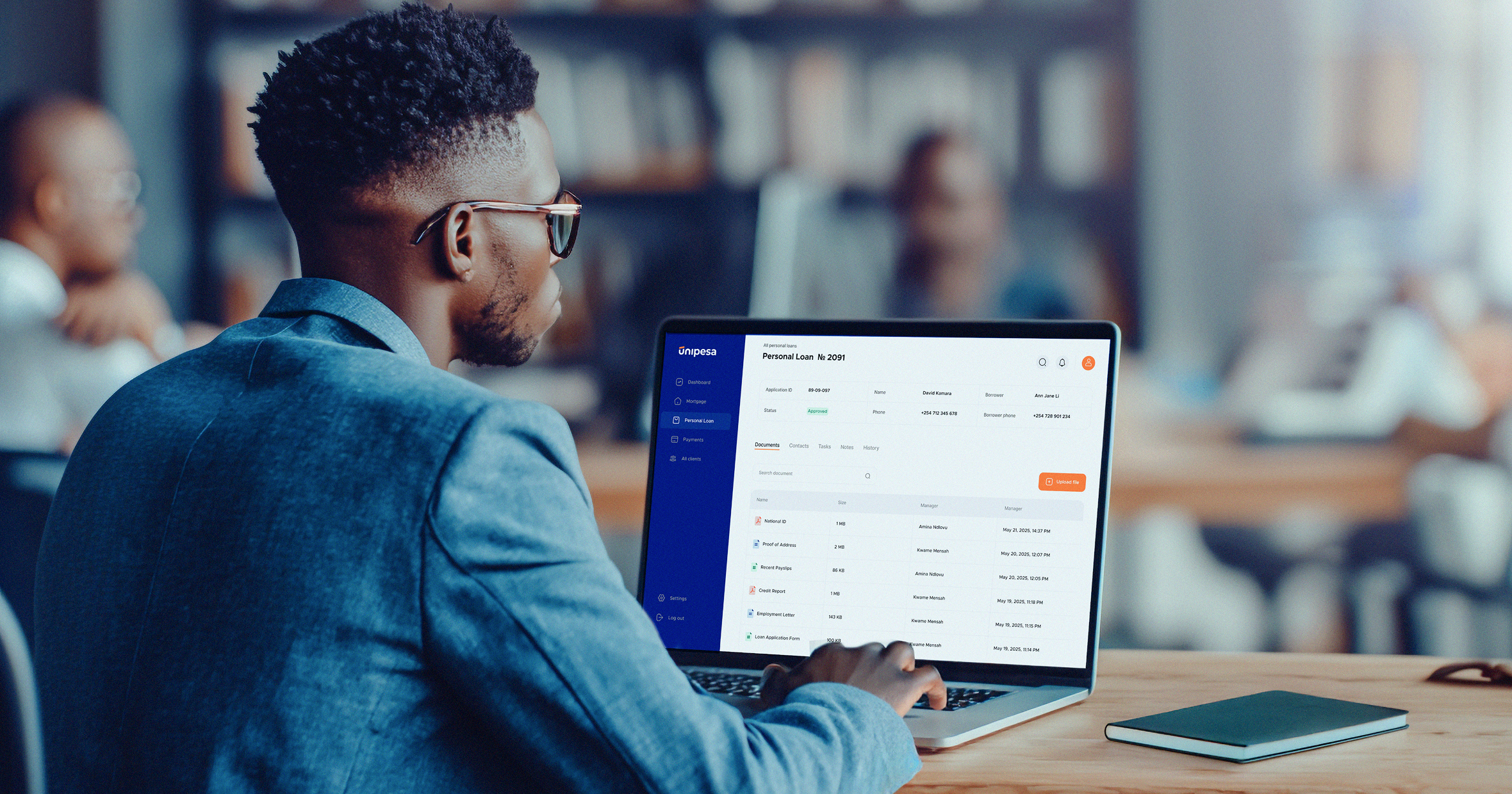

Lending platform with built-in scoring and KYC

Launch BNPL, SME loans, or microfinance flows — pre-integrated with scoring, disbursement, and repayment logic.

Wallet platform for consumers and SMEs

Offer branded digital wallets with account control, KYC, and transaction history out of the box.

Digitize onboarding and collections

Streamline customer journeys and reduce friction using Unipesa’s ready-made flows and compliant infrastructure.

Expanded local presence

Banks reach more customers through agent networks and Unipesa POS, reducing reliance on branches.

If you’re a bank or MFI in Africa looking to digitize faster, let’s talk.

Unipesa is designed to power exactly this kind of business — and we’re ready to support your next move.

Use case example from a regional microfinance bank.

Let’s build something together

We’ll walk you through the platform, answer your questions, and show you how fast you can launch with Unipesa.