Unipesa ecosystem

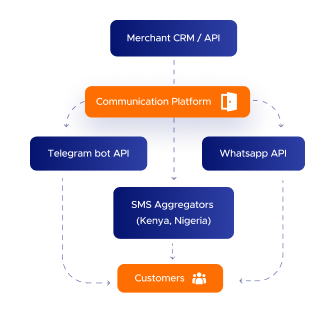

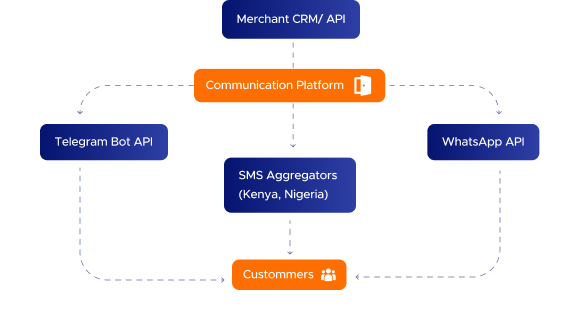

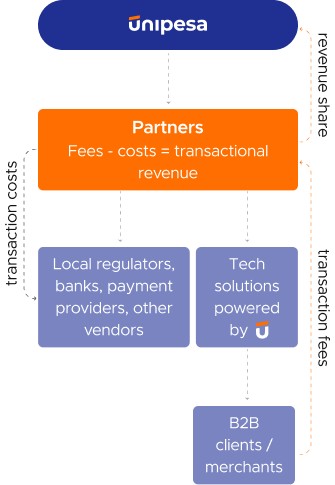

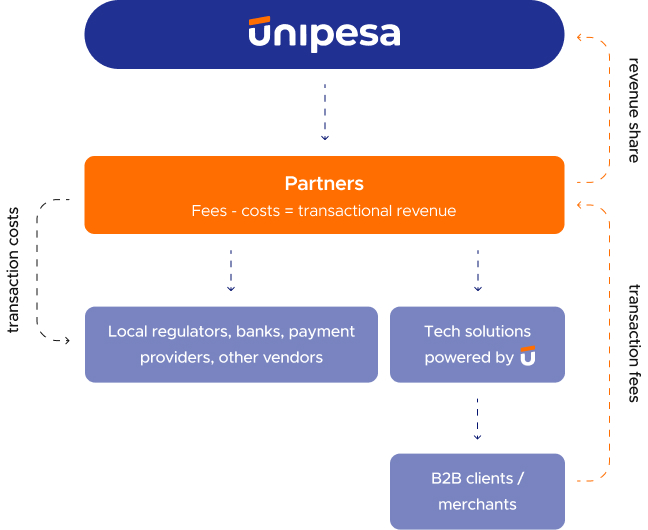

Unipesa supports local payment companies, banks, financial operators, and government agencies across African region. Acting as a technical partner, Unipesa handles platform deployment, operations, and integrations, while partners focus on business development, growth, and scale.

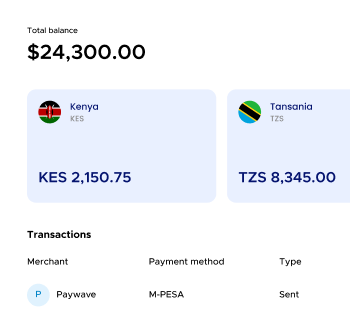

The company operates on a transactional revenue share model and connects all partners into a unified financial network.

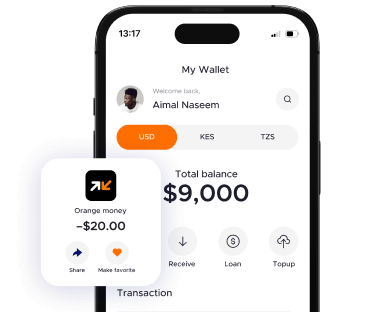

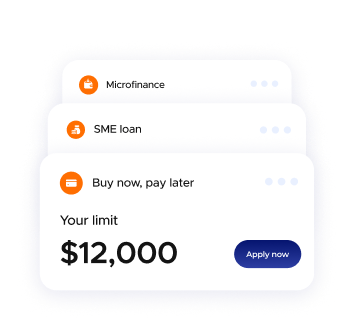

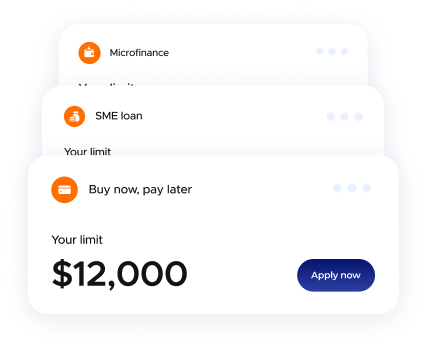

Unipesa is a fintech solutions developer with a fully in-house–built portfolio of products. Each product is delivered as a white-label platform, branded for every client and empowering them to run their own fintech business or unlock new opportunities and revenue streams within their existing business.