Payment Companies and providers

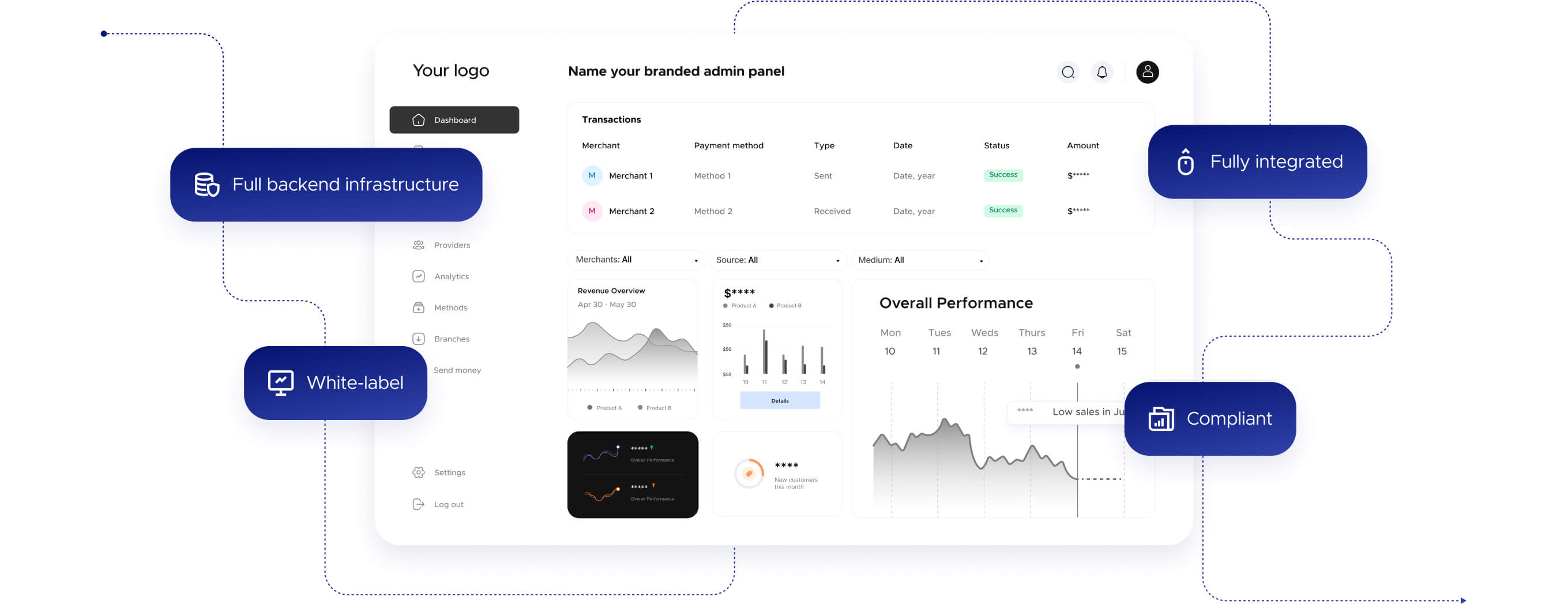

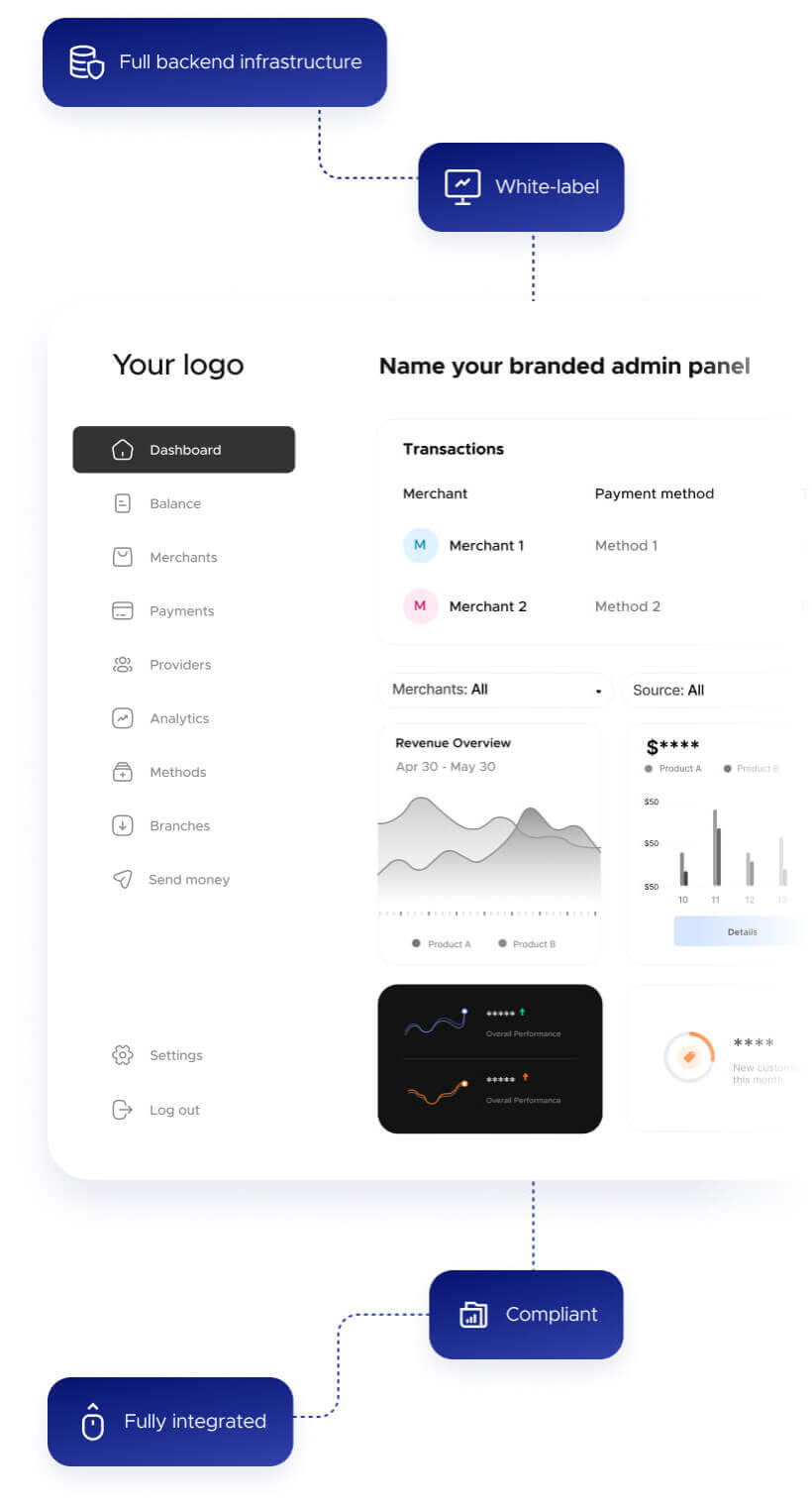

Whether you’re building a new PSP or scaling an existing one, Unipesa provides the full backend infrastructure — white-label, fully integrated, and compliant — so you can focus on growth, not technology.

Challenges for PSPs in Africa

-

Fragmented payment channels across countries and currencies require a lot of API integrations, maintenence, and management.

-

Long time-to-market and high cost of in-house development.

-

Operational burden of customer support, reconciliation, fraud protection.

-

Complex and fast-changing regulatory environments.

-

Difficulties in onboarding merchants and maintaining uptime.

Solution: your infrastructure ready from day one

Multi-channel access via one platform

150+ payment channels across Africa, including mobile money, cards, wallets, QR, USSD.

No-code, white-label infrastructure

Launch your PSP with your brand, without building the tech stack.

Unified merchant back-office

Manage onboarding, support, settlements, and reporting from day one.

Security and compliance built-in

PCI DSS certified, AI-powered fraud detection, real-time risk scoring.

Operations support

We handle merchant technical support, reconciliations, and integrations with payment channels.

Expand into new regions instantly

Launch in new countries using pre-integrated payment channels.

If you’re building or scaling a payment company in Africa, let’s talk

Unipesa is designed to power exactly this kind of business — and we’re ready to support your next move

Real use case from a regional PSP

Let’s build something together

We’ll walk you through the platform, answer your questions, and show you how fast you can launch with Unipesa.