Lending platform

From personal loans to SME financing, get everything you need to originate, disburse, manage, and collect — seamlessly across mobile, web, and POS

Launch, brand, and automate your own digital lending.

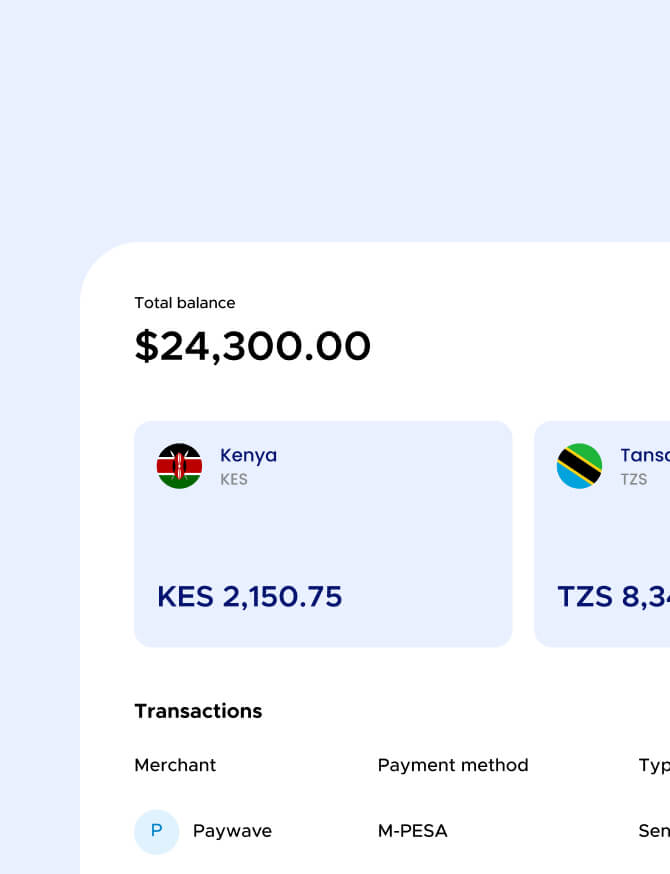

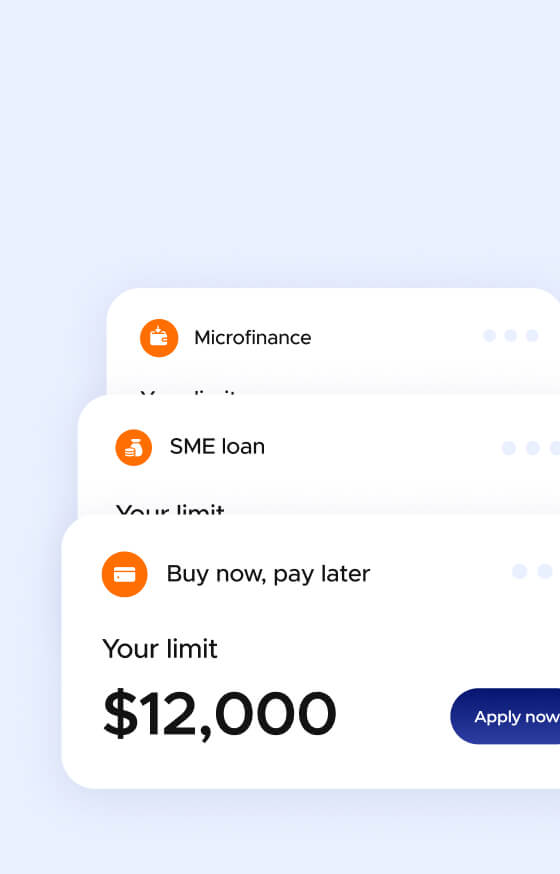

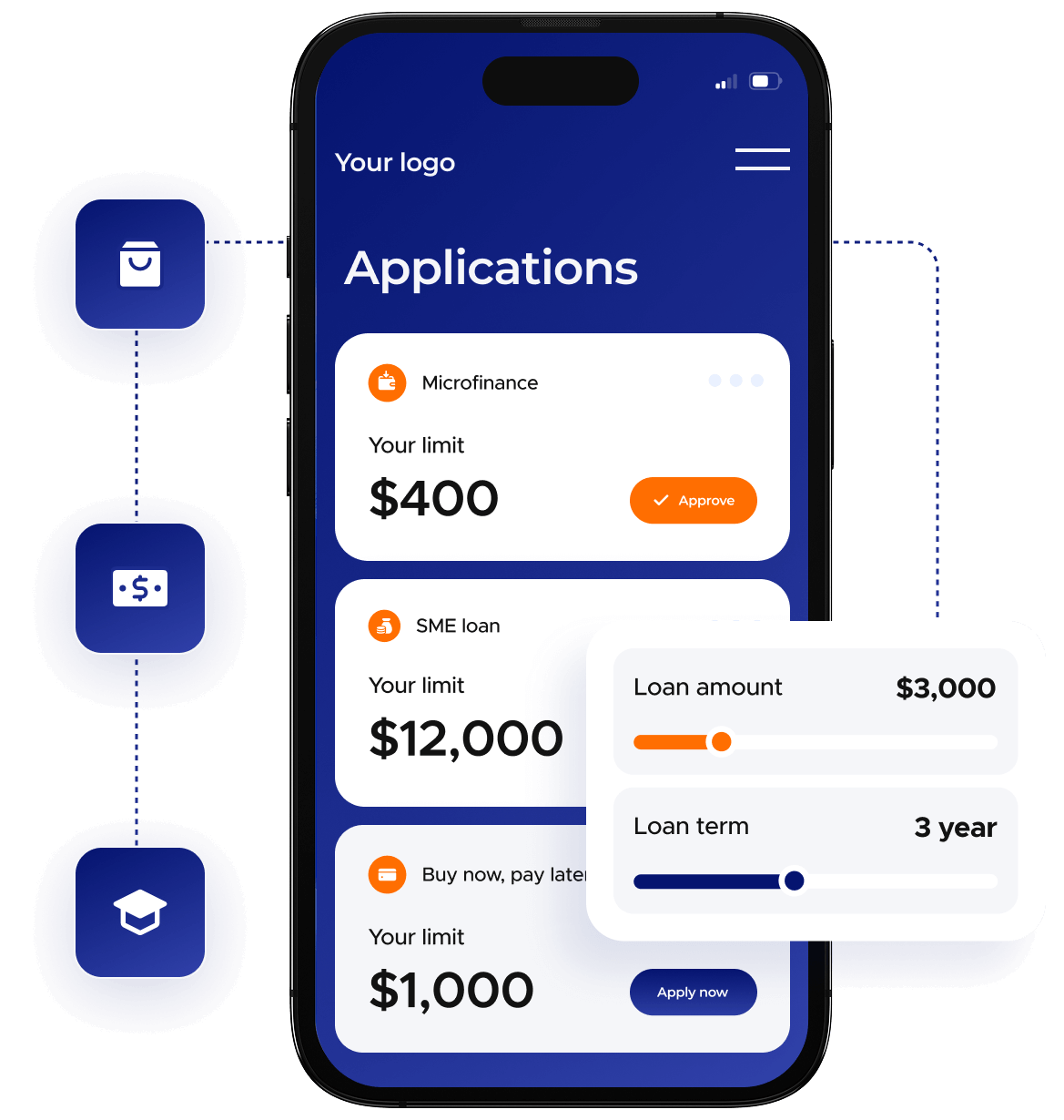

Lending lifecycle management

- Full-cycle lending: origination, scoring, disbursement, servicing, collections.

- Real-time dashboards for portfolio and repayment tracking.

- Modular flows for retail, SME, BNPL, education, and more.

Borrower onboarding & risk control

- Embedded KYC and borrower onboarding (app, web, agent).

- AI-powered risk engine and fraud detection.

- PCI DSS & ISO 27001-ready infrastructure.

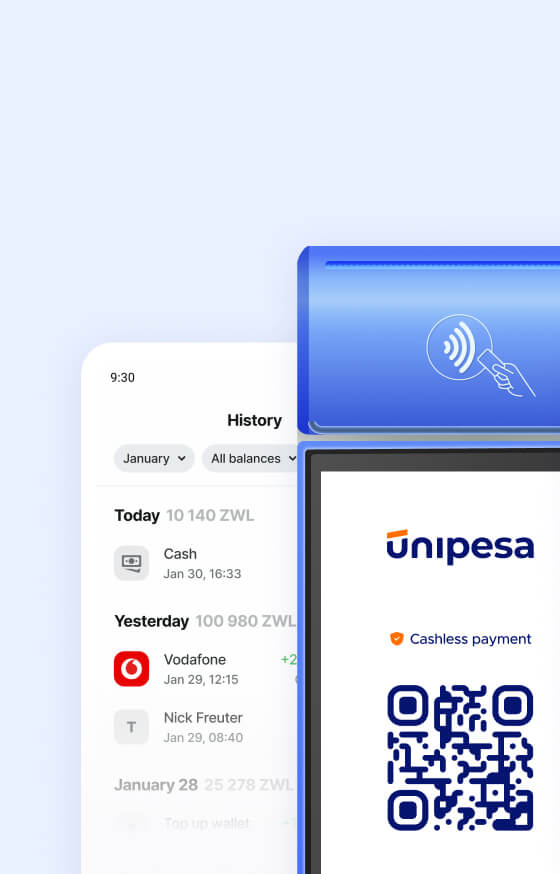

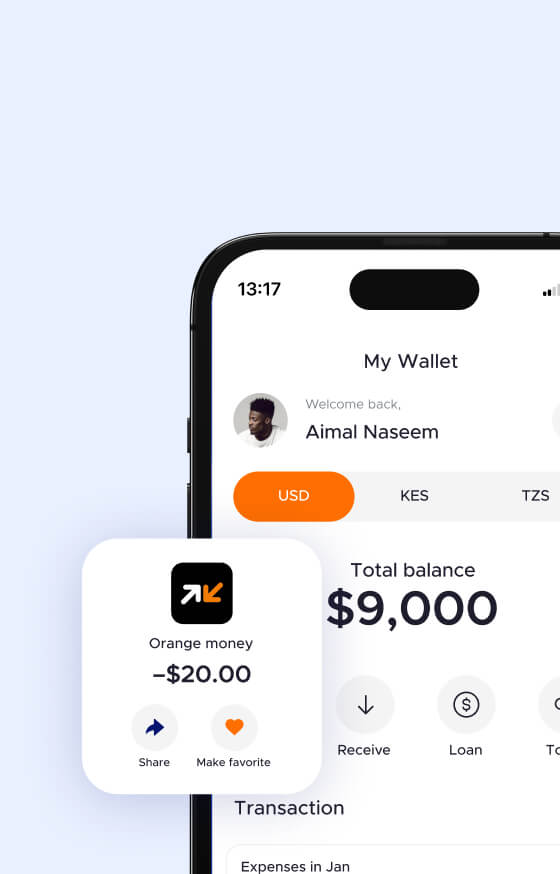

Multi-channel access & integrations

- Agent and borrower portals (white-label).

- Works with mobile money, bank accounts, wallets, cards.

We launched SME loans across 3 regions in just one month: fully branded, automated, and integrated with our POS agents. Recovery improved, and loan approvals scaled 5X.

Head of credit ops

Microfinance provider (Ghana)

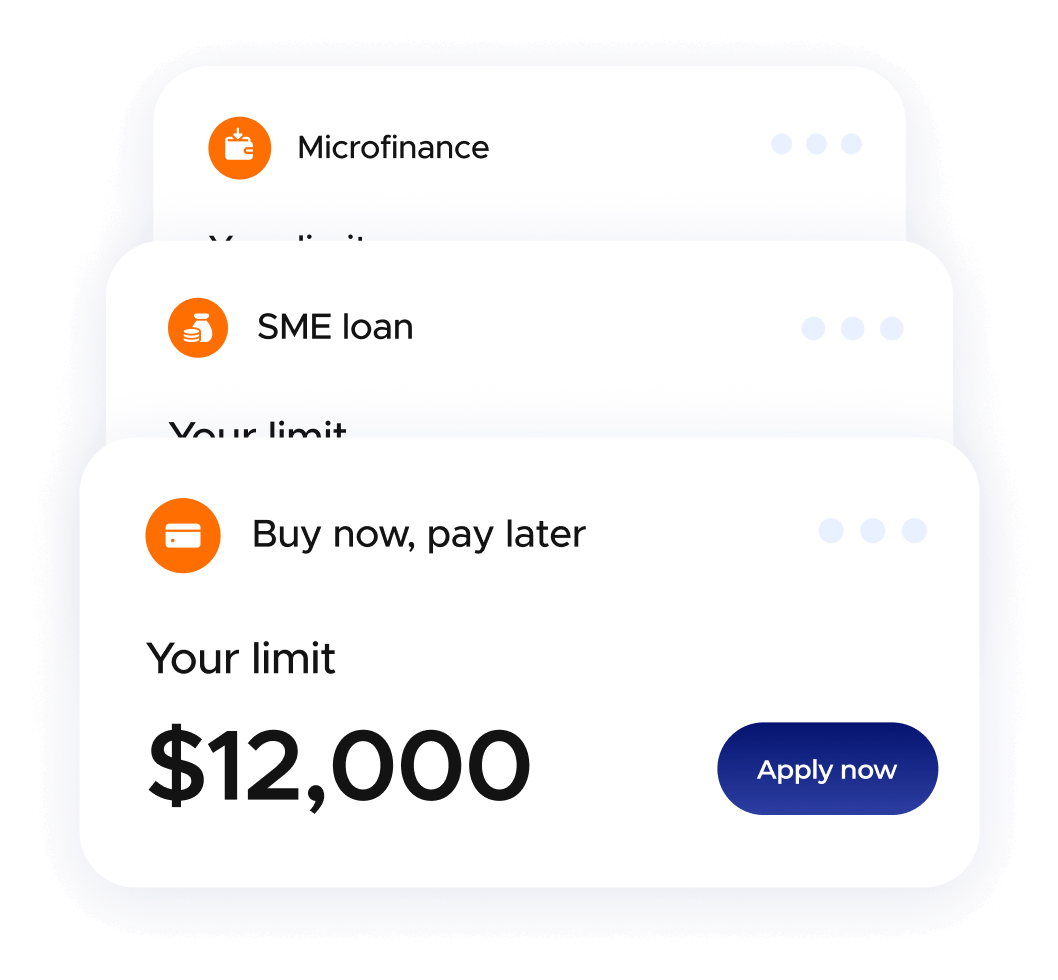

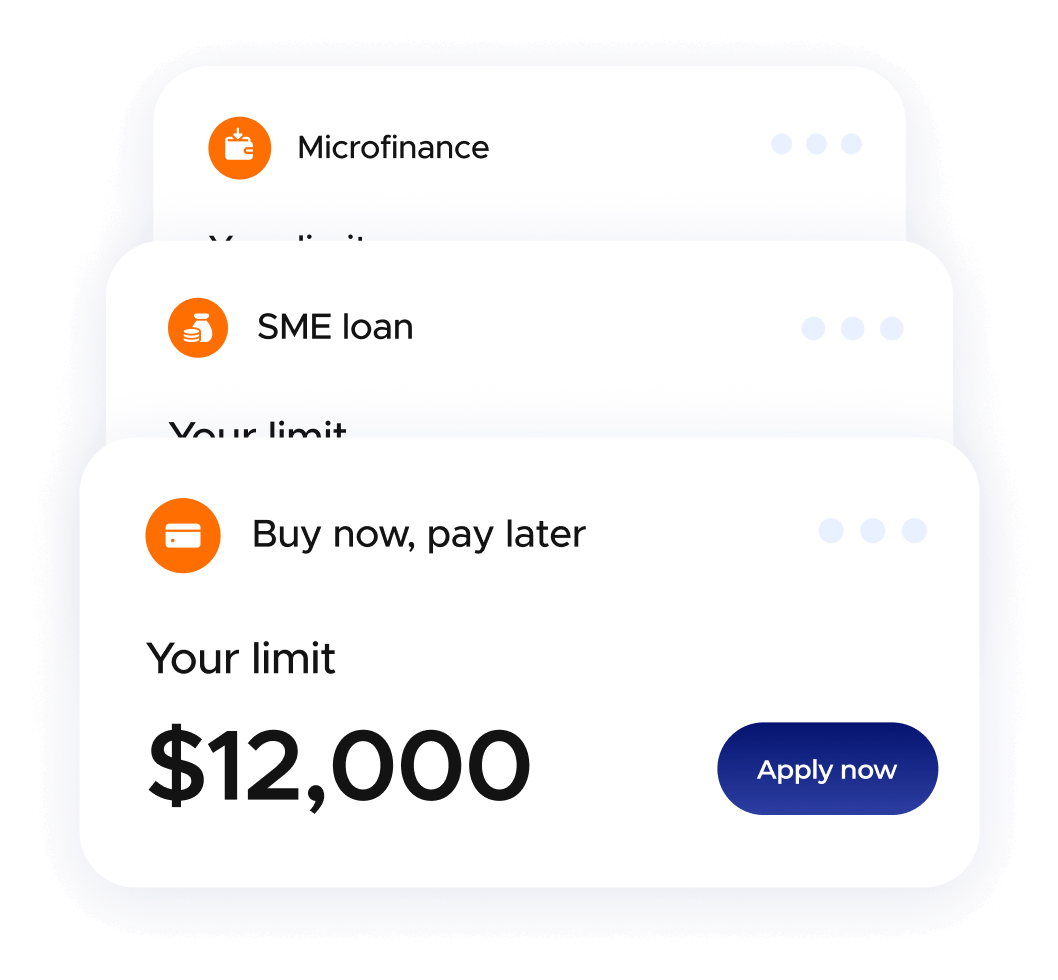

Supported use cases

Lending that fits your market

Salary advances and payday loans

SME and micro-enterprise credit

Education loans and tuition instalments

BNPL and retail financing

Solar, agriculture and mobility loans

Agent working capital

Credit lines, cards and overdrafts

Islamic finance and custom models

How does it work

Get an easy way to automate lending, borrowing, and debt collection — and earn on every transaction.

1. Platform deployment

The partner provides a domain, and Unipesa deploys a branded platform with partner's logo and colours.

2. Scoring Providers integration

The partner contracts with credit bureaus or verification agencies for scoring. Unipesa handles technical integration.

3. Customer acquisition

The partner promotes its lending service, handles customer acquisition, defines commercial terms, and manages KYC.

4. Make profit

Customers use the Partner’s lending service and pay fees on the loans they borrow.

Pricing aligned with your growth. Simple, fair, and transparent.

We don’t charge per API call or force you into long-term licenses. You pay once to launch — and we earn when you do, through simple revenue sharing. We handle the heavy lifting.

Let’s build something together

We’ll walk you through the platform, answer your questions, and show you how fast you can launch with Unipesa.

Boost your business with our all-in-one payment products ecosystem

Lending platform