Payment orchestration platform

Launch and scale your payment company with 200+ payment channels across Africa.

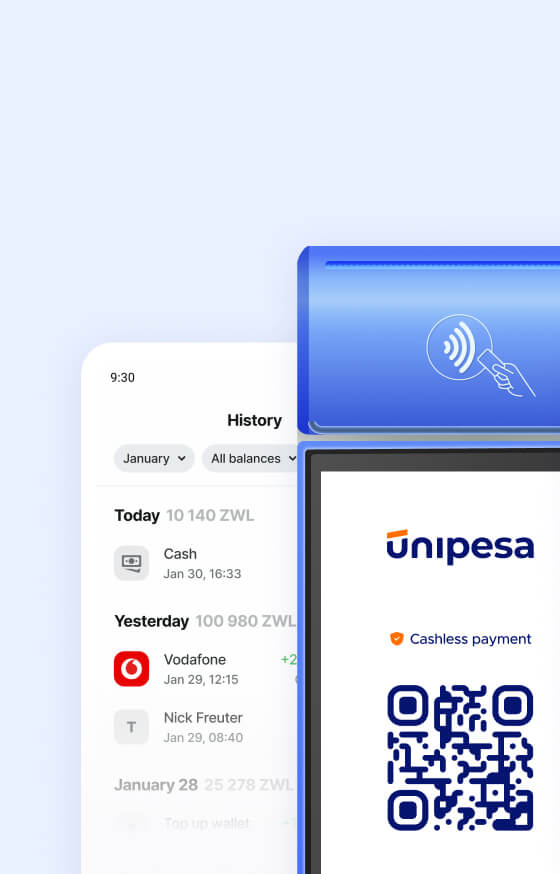

Launch your own payment business — fast.

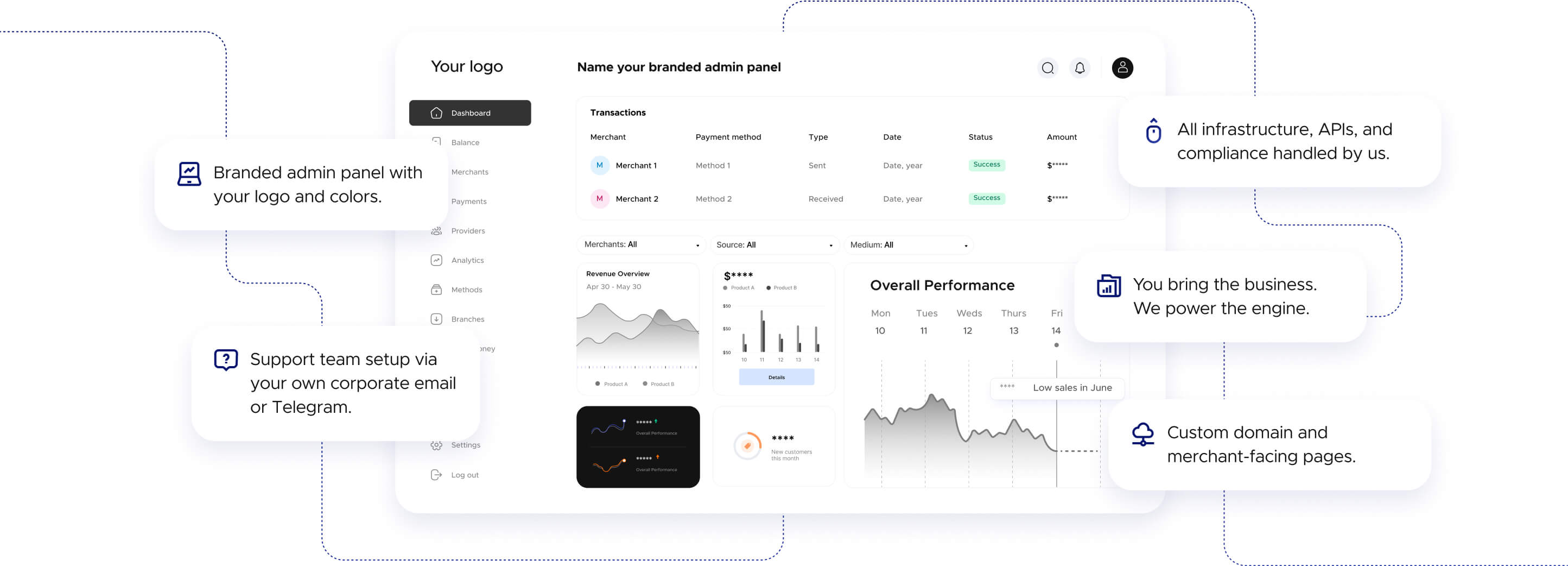

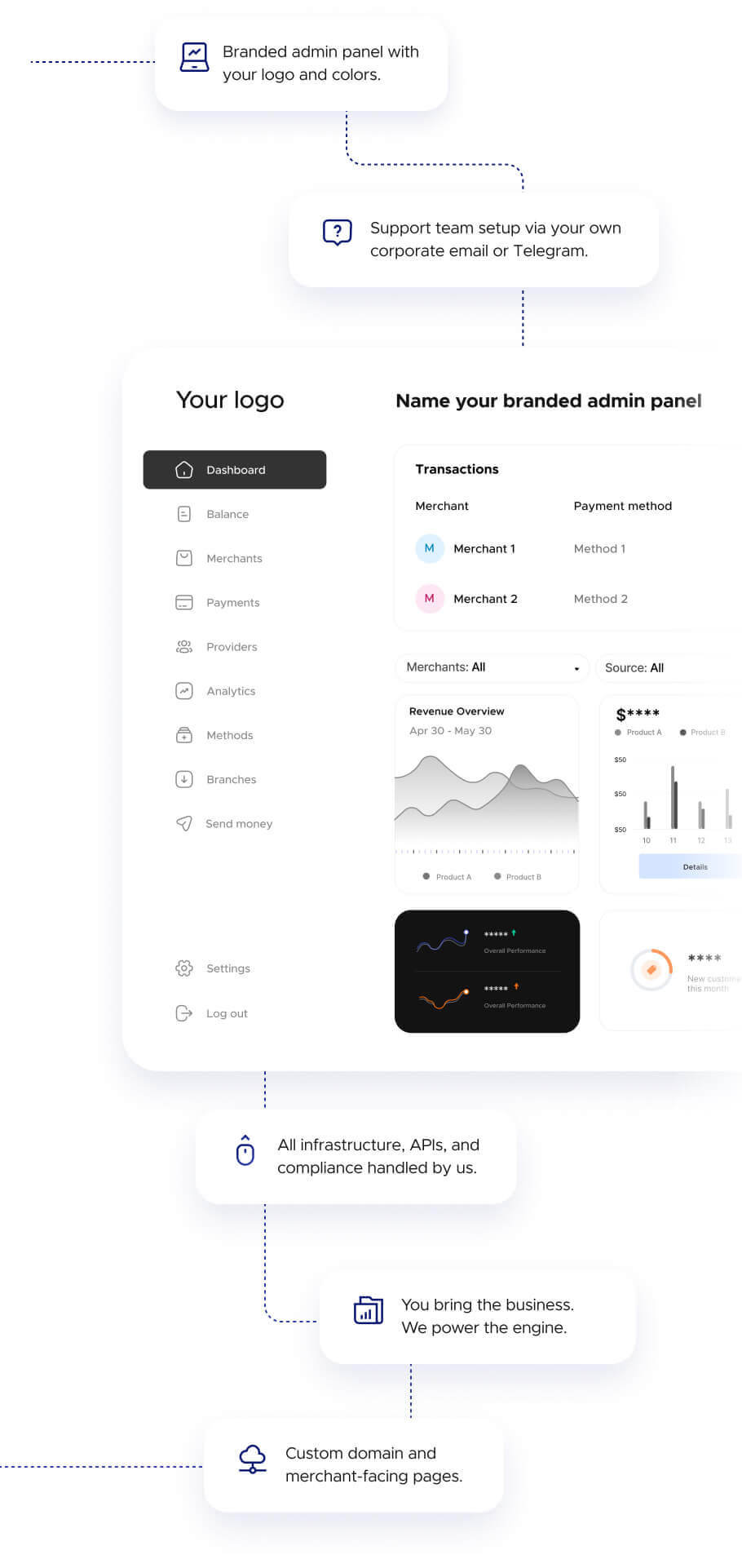

White-label ready from day one Unipesa empowers you to deploy a fully branded, enterprise-level payment infrastructure under your own name. Ideal for banks, fintechs, payment companies and aggregators. What’s included:

How does it work

1. Payment platform deployment

The partner provides a domain, and Unipesa deploys a branded platform with partner's logo and colours.

2. Payment channels integration

The partner contracts payment providers and telcos, Unipesa handles technical integration.

3. Merchant acquisition

The partner leads merchant acquisition, defines commercial terms, and signs contracts directly with onboarded merchants.

4. Make profit

Unipesa provides merchants with technical support and manages reconciliation. Merchants pay fees per transaction.

Local coverage. Global scalability.

Core Infrastructure

- Smart API routing and microservices architecture

- PCI DSS and ISO / IEC 27001 compliant infrastructure

- Multi-currency and multi-market ready

- Embedded finance and bulk payouts

Control and transparency

- Enterprise-grade back office and access control

- Transparent analytics and transaction visibility

- Built-in AI fraud detection and risk engine

- Role-based access and audit logging

Business operations

- Real-time payments and reconciliation

- Billing-ready for marketplaces, payroll use cases

- Money collection, payouts, and balance tracking

- Invoicing, salaries, and business logic automation

“Complying in 3 markets without tech overhead? That’s why we chose them.”

Operations lead

Digital platform (Senegal)

Covering the most used payment methods in Africa. One API — endless flexibility.

We support direct integrations with all major channels:

Enterprise-grade technology, built for scale.

Unipesa’s core runs on modern cloud infrastructure with microservices and RESTful APIs. Our platform ensures maximum availability, high throughput, and fast deployment. Security is at the heart of it all:

TLS 1.3 encrypted data

transmission

PCI DSS-compliant

encryption at every layer

Two-factor user

authentication

Remote disaster recovery

and live failover systems

We combine this with real-time fraud monitoring, tokenization, and customizable rule-based filters for every transaction.

We use AI, machine learning, tokenization, custom fraud settings, and a proprietary risk engine for real-time fraud detection and risk management.

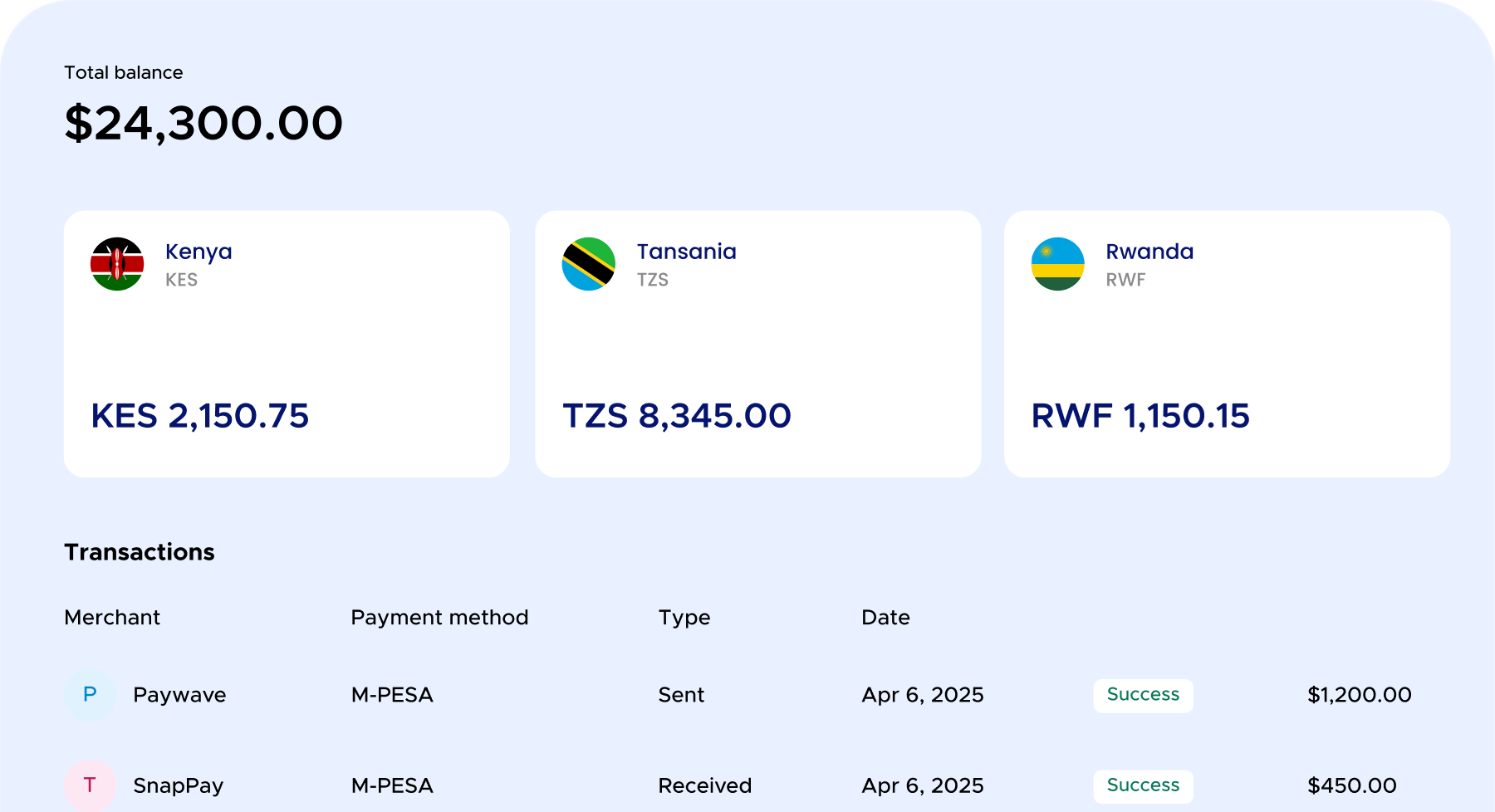

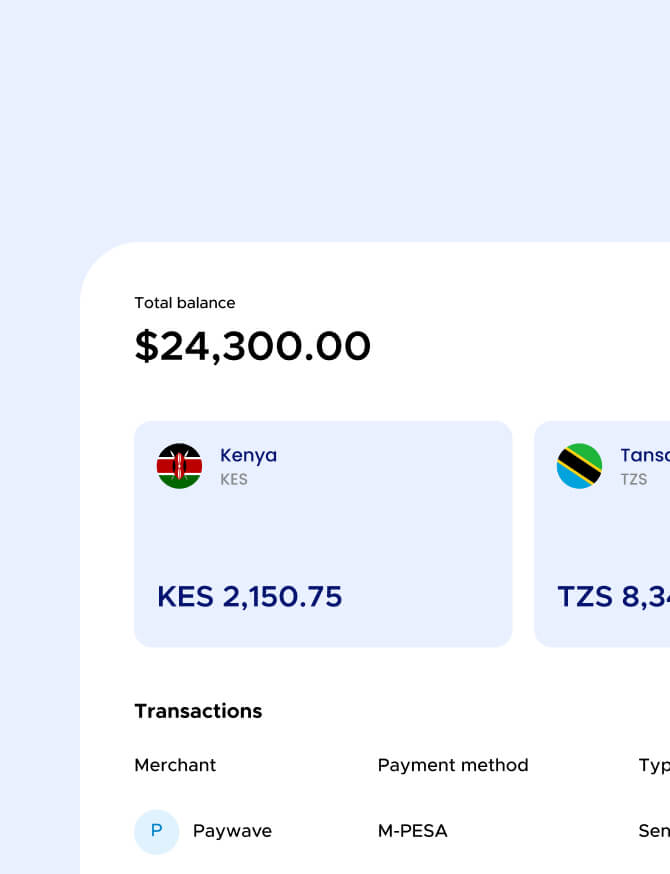

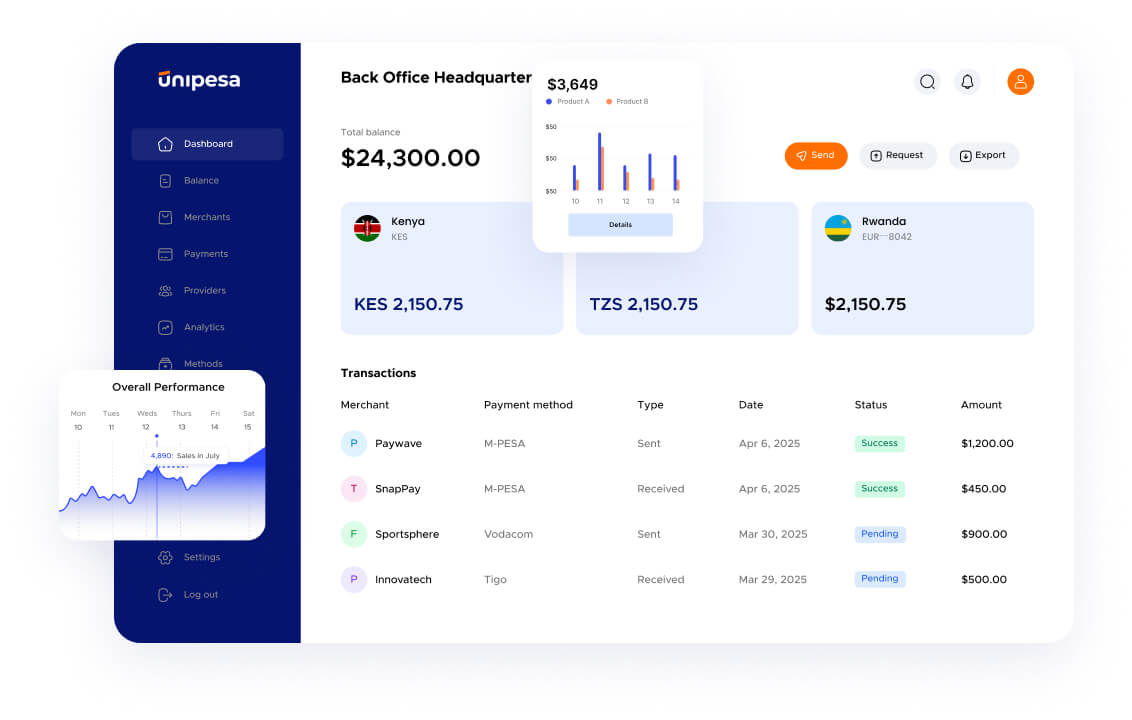

Advanced back office to control every transaction.

Manage your entire payment operation from a flexible, intuitive admin interface:

-

Full control over pricing and tariffs.

-

Enable / disable payment gateways by region.

-

Access levels and permissions for teams.

-

Real-time analytics and status monitoring.

-

Automated reconciliation and settlement management.

-

Onboarding flow for new partners and merchants.

Pricing aligned with your growth. Simple, fair, and transparent.

We don’t charge per API call or force you into long-term licenses. You pay once to launch — and we earn when you do, through simple revenue sharing. We handle the heavy lifting.

Let’s build something together

We’ll walk you through the platform, answer your questions, and show you how fast you can launch with Unipesa.

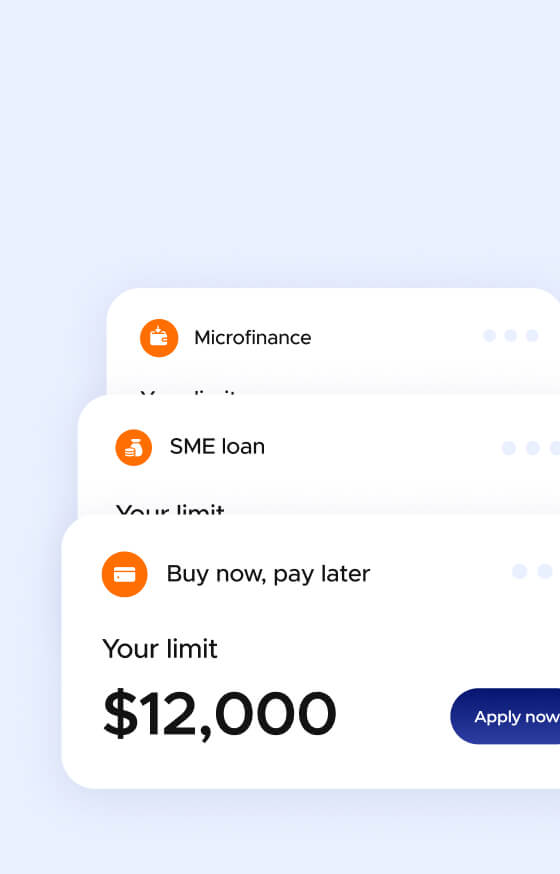

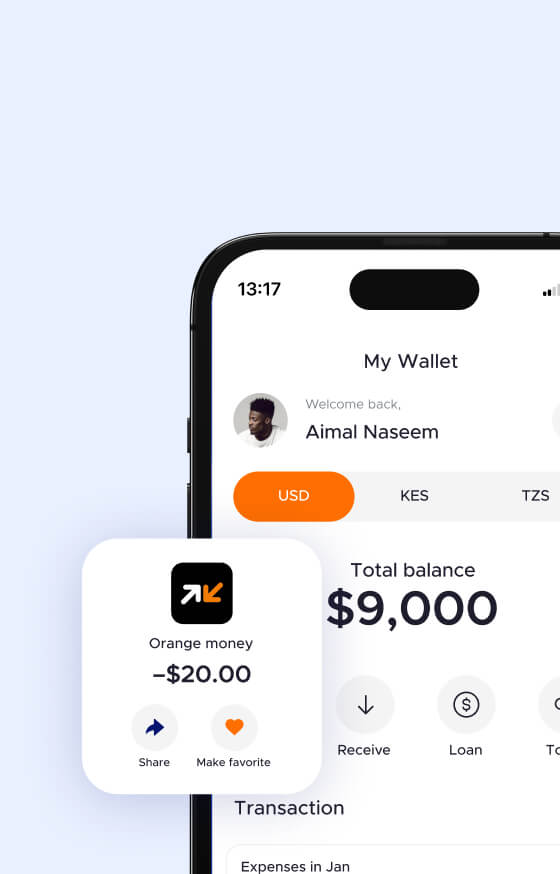

Boost your business with our all-in-one payment products ecosystem

Payment platform