From Bill Payments to Mobile Loans: How Fintech is Making Life Easier for Nigerians

In Nigeria, financial services used to be defined by queues. Long lines at bank branches, complex paperwork for loans, and delays in bill settlements shaped how people interacted with money. By 2025, that landscape has changed dramatically. Today, the smartphone is the new branch, and fintech has redefined convenience in daily life.

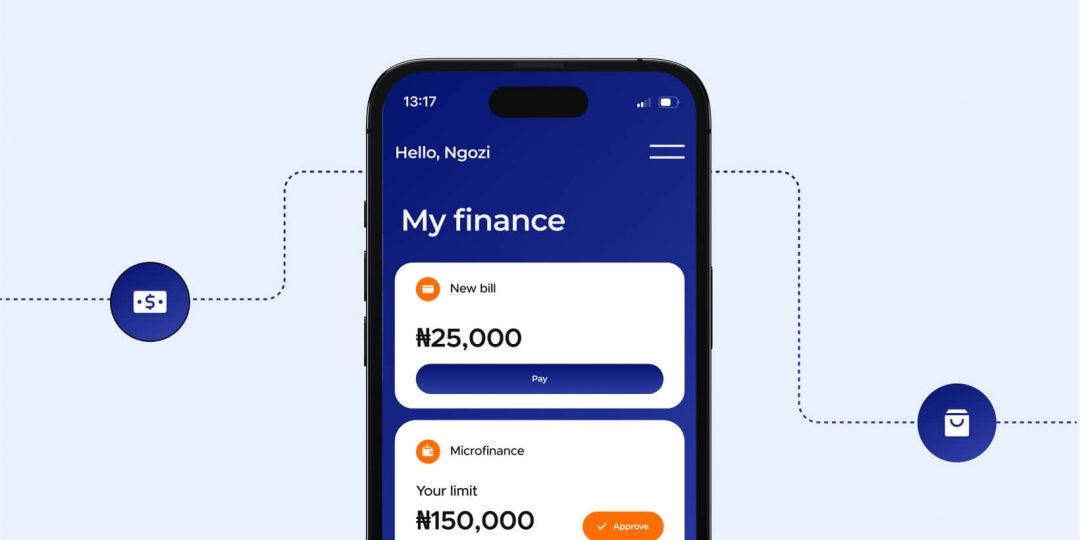

From paying electricity bills to accessing instant loans, Nigerians are experiencing financial services that are faster, cheaper, and more accessible than ever. But this shift isn’t happening by magic. Behind the sleek apps and intuitive interfaces lies an infrastructure layer – companies like Unipesa – that makes these services reliable at scale.

Bill Payments: From Frustration to One-Click

One of the most immediate ways fintech has improved daily life is through bill payments.

Not long ago, Nigerians had to stand in line to pay for electricity or purchase airtime from local kiosks. Payment delays meant service disruptions, and reconciliation was slow and error-prone.

Today, mobile apps allow these transactions in seconds. Airtime, data bundles, electricity tokens, and even cable subscriptions can be purchased instantly. Payment confirmations arrive in real-time, reducing stress for households and businesses alike.

What enables this is not just the user-facing apps but the infrastructure underneath. Unipesa, for example, provides integration with billers, payment processors, and mobile money operators. By standardizing these connections, it ensures that when a user taps “pay,” the transaction is cleared instantly and securely.

Everyday Commerce and Lifestyle

Beyond household bills, fintech has quietly transformed everyday commerce in Nigeria. Street vendors, ride-hailing drivers, and e-commerce merchants now accept digital payments through QR codes, USSD, or mobile apps.

This is not just about convenience – it’s about trust and accountability. Digital payments create transaction records, which help small businesses build credit histories and gain access to formal financial products.

Unipesa plays an unseen role here. By powering merchant integrations and settlement rails, it makes digital transactions accessible even to micro-entrepreneurs who cannot afford the overhead of traditional banking infrastructure.

The Rise of Mobile Loans

Perhaps the most dramatic shift in Nigeria’s fintech landscape is access to credit. For decades, formal loans were out of reach for most citizens. Banks required collateral, formal employment records, or lengthy application processes – barriers that excluded millions of Nigerians working in the informal economy.

Fintech has changed the equation. Mobile loans are now available within minutes, often requiring nothing more than a phone number, transaction history, and digital identity verification. Loan disbursement and repayment happen directly through mobile wallets or bank accounts.

While this has sparked concerns about over-borrowing and predatory practices, the underlying reality is transformative: credit is no longer a privilege for the few but a tool available to the many.

Infrastructure players like Unipesa make this possible. Their platforms provide the rails for disbursement, compliance checks for KYC/AML, and settlement systems that ensure lenders and borrowers can transact securely. Without this backbone, mobile loan apps would collapse under the weight of regulatory, liquidity, or fraud challenges.

Financial Inclusion in Practice

The concept of “financial inclusion” often feels abstract, but in Nigeria it has become concrete. Millions of people who once operated entirely in cash now use digital channels for payments, savings, and credit.

The impact is felt in multiple ways:

- Rural access: Farmers receive payments for produce directly into mobile wallets, reducing reliance on middlemen.

- Youth empowerment: Young Nigerians, many of whom are “mobile-first,” can manage their finances without ever entering a traditional bank.

- Women in business: Digital finance provides new tools for women entrepreneurs, who often face higher barriers to accessing credit.

This ecosystem works only because infrastructure providers like Unipesa bridge the gaps between banks, mobile money operators, and fintech startups. They create a unified layer that brings financial services closer to everyday Nigerians.

The Role of Regulation

Nigeria’s regulatory environment has been both a driver and a gatekeeper. The Central Bank of Nigeria (CBN) has encouraged innovation while also tightening oversight, particularly around digital lending and cross-border transactions.

For fintechs, navigating this landscape can be complex. Each license, compliance requirement, or integration adds operational overhead.

This is where infrastructure becomes critical. Unipesa embeds compliance checks and regulatory requirements directly into its platform, allowing fintech startups to launch services faster and operate legally from day one. In effect, Unipesa lowers the regulatory barrier while still keeping the system safe.

The Everyday Nigerian Experience

To understand the significance of fintech in Nigeria, consider three simple stories:

- A Lagos commuter pays for a bus ride using a QR code, saving cash for emergencies.

- A university student tops up data instantly before an online lecture.

- A small trader in Aba secures a short-term loan to restock goods, repaying automatically from sales.

Each scenario feels ordinary today, but only because the infrastructure works invisibly in the background. Without it, daily life would still be marked by queues, uncertainty, and cash dependency.

Beyond Convenience: Building an Economy

The shift from cash-based transactions to digital finance is not only about individual convenience; it is reshaping Nigeria’s economy. Digital payments create data trails, which in turn build credit histories, fuel analytics, and support better decision-making for both businesses and regulators.

Access to credit allows SMEs – the lifeblood of Nigeria’s economy – to scale operations. Reliable bill payments reduce service interruptions, improving productivity. Digital commerce expands consumer choice and market reach.

Unipesa’s role here is pivotal. Standardizing integrations, securing transactions, and embedding compliance it enables this growth at scale. It is not just a service provider – it is part of the national financial backbone.

Challenges That Remain

Despite rapid progress, challenges persist:

- Digital divide: Rural areas still suffer from patchy connectivity and limited smartphone penetration.

- Trust issues: Some Nigerians remain wary of digital loans due to aggressive debt collection practices by certain providers.

- Infrastructure strain: As transaction volumes rise, systems must scale without outages or vulnerabilities.

Here again, infrastructure matters. Companies like Unipesa focus on resilience – building platforms that can handle surging demand while maintaining regulatory compliance and user trust.

Looking Ahead: The Next Five Years

Nigeria’s fintech ecosystem is poised for another wave of transformation. Likely trends include:

- Deeper credit innovation: More sophisticated loan products tied to income flows, not just mobile data.

- Embedded finance: Payment and loan services integrated directly into e-commerce platforms, logistics apps, and social marketplaces.

- Cross-border expansion: Nigerian fintechs increasingly targeting regional markets, requiring scalable infrastructure like Unipesa to handle complexity.

- Digital identity integration: Stronger links between national ID systems and fintech platforms, streamlining KYC processes.

In all these scenarios, infrastructure players will remain central. The future of fintech in Nigeria is not just about who builds the most popular app, but who maintains the rails that make those apps viable.

Conclusion

Nigeria’s fintech story is often told in terms of apps and entrepreneurs. But the deeper truth is that its impact lies in infrastructure quietly enabling everyday life. From bill payments to mobile loans, Nigerians are experiencing a financial revolution not because of individual apps alone, but because of the backbone platforms – like Unipesa – that make the system work reliably.

The queues of yesterday are fading into memory. In their place, a new normal has emerged: fast, transparent, and accessible financial services woven into the rhythm of daily life. This is more than convenience; it is the foundation of a more inclusive and resilient Nigerian economy.