About us

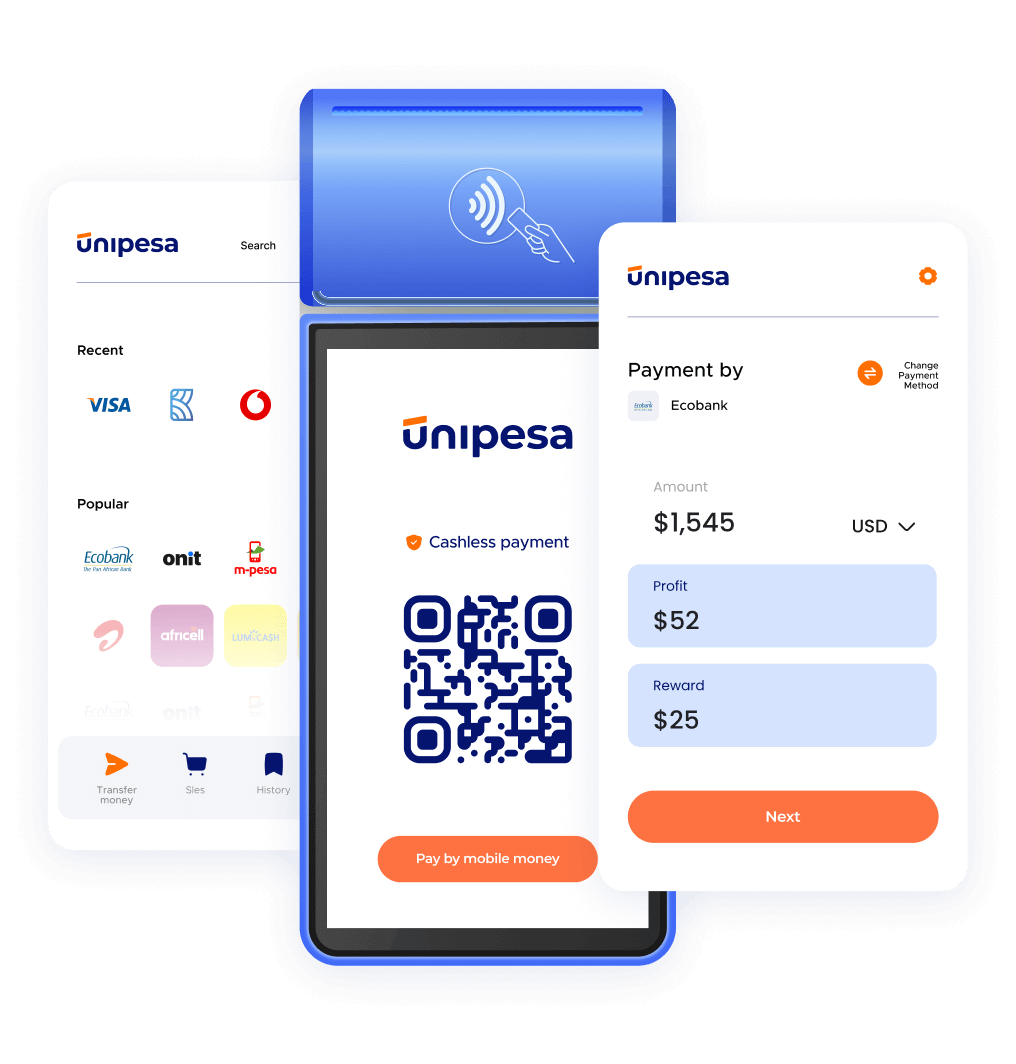

Unipesa enables fintech companies, payment providers, agent networks, banks, and government institutions with the tools and network to grow.

Launch, expand, and add revenue — without time-consuming and costly in-house development or maintenance. With Unipesa you can:

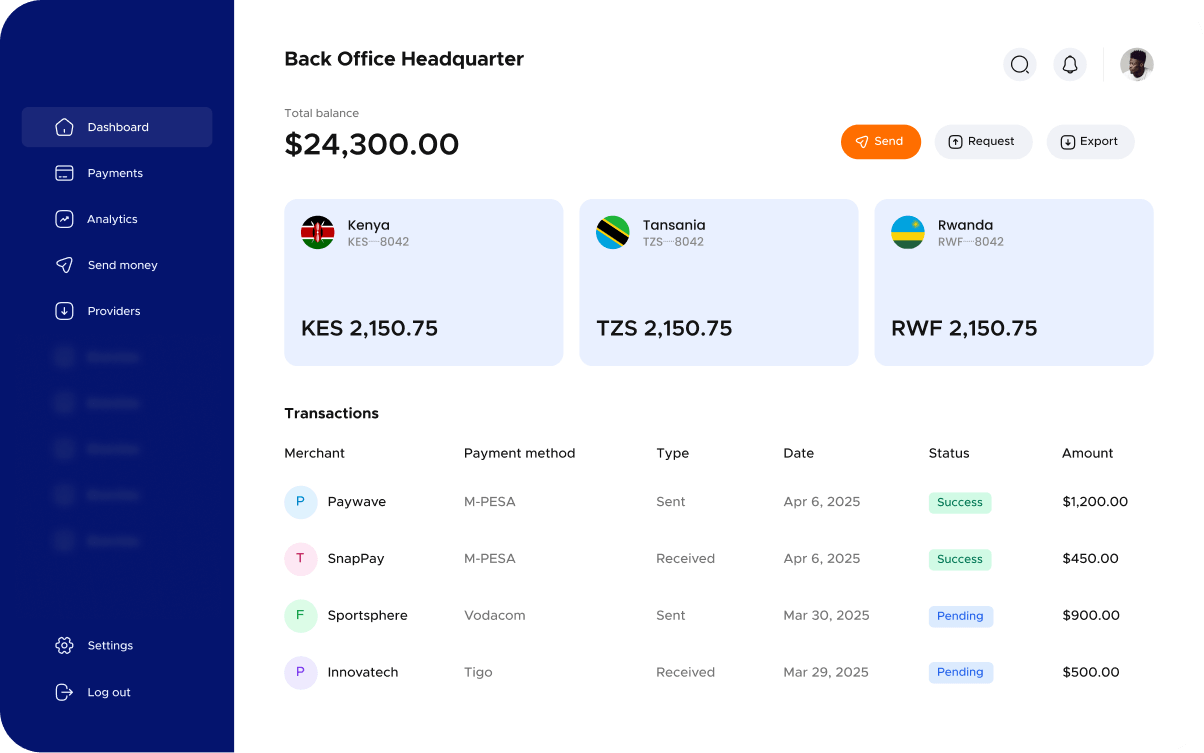

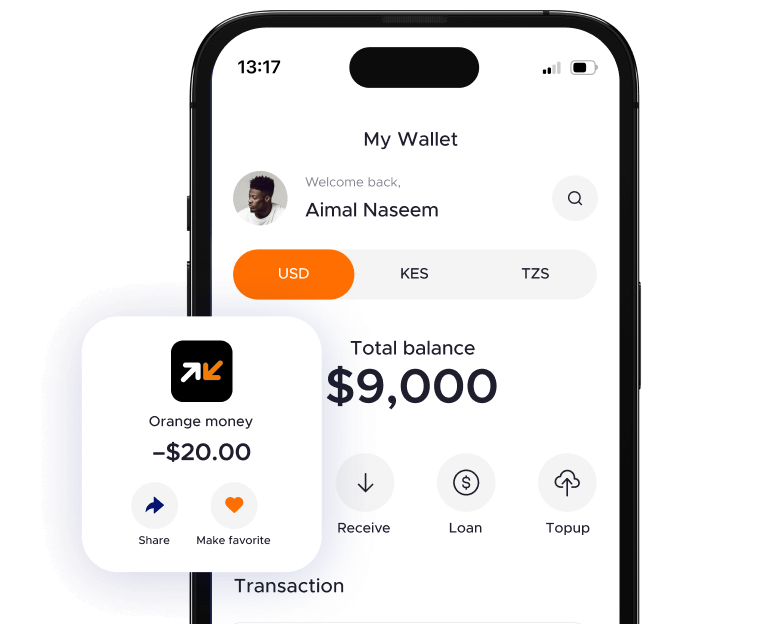

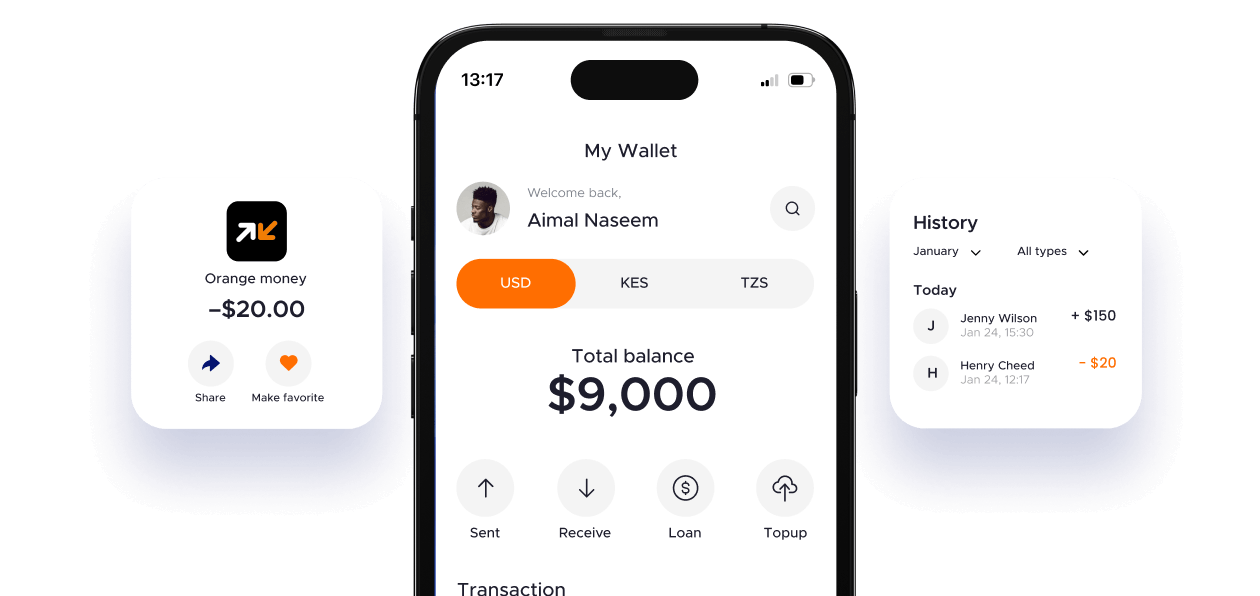

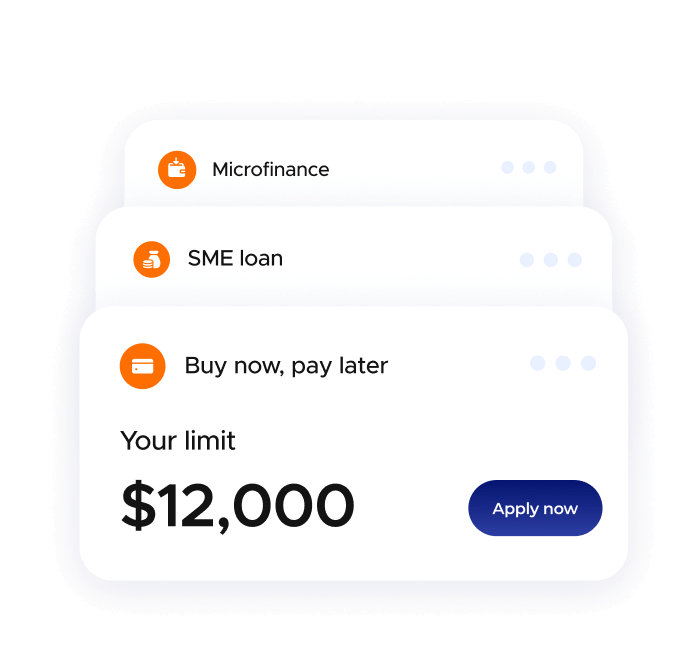

- Launch payments, remittances, lending, and more.

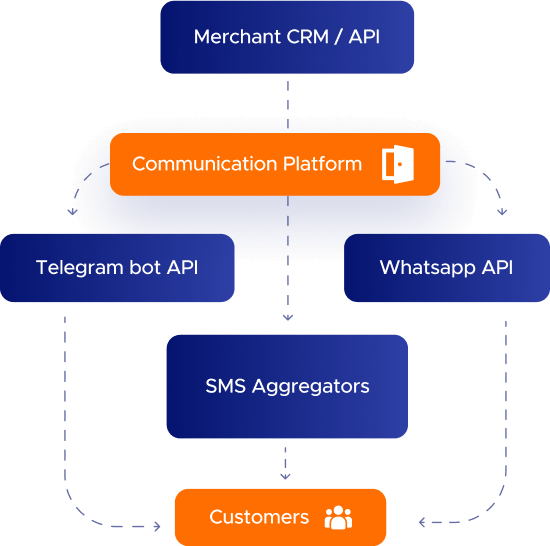

- Aggregate multiple payment and communications channels in one platform.

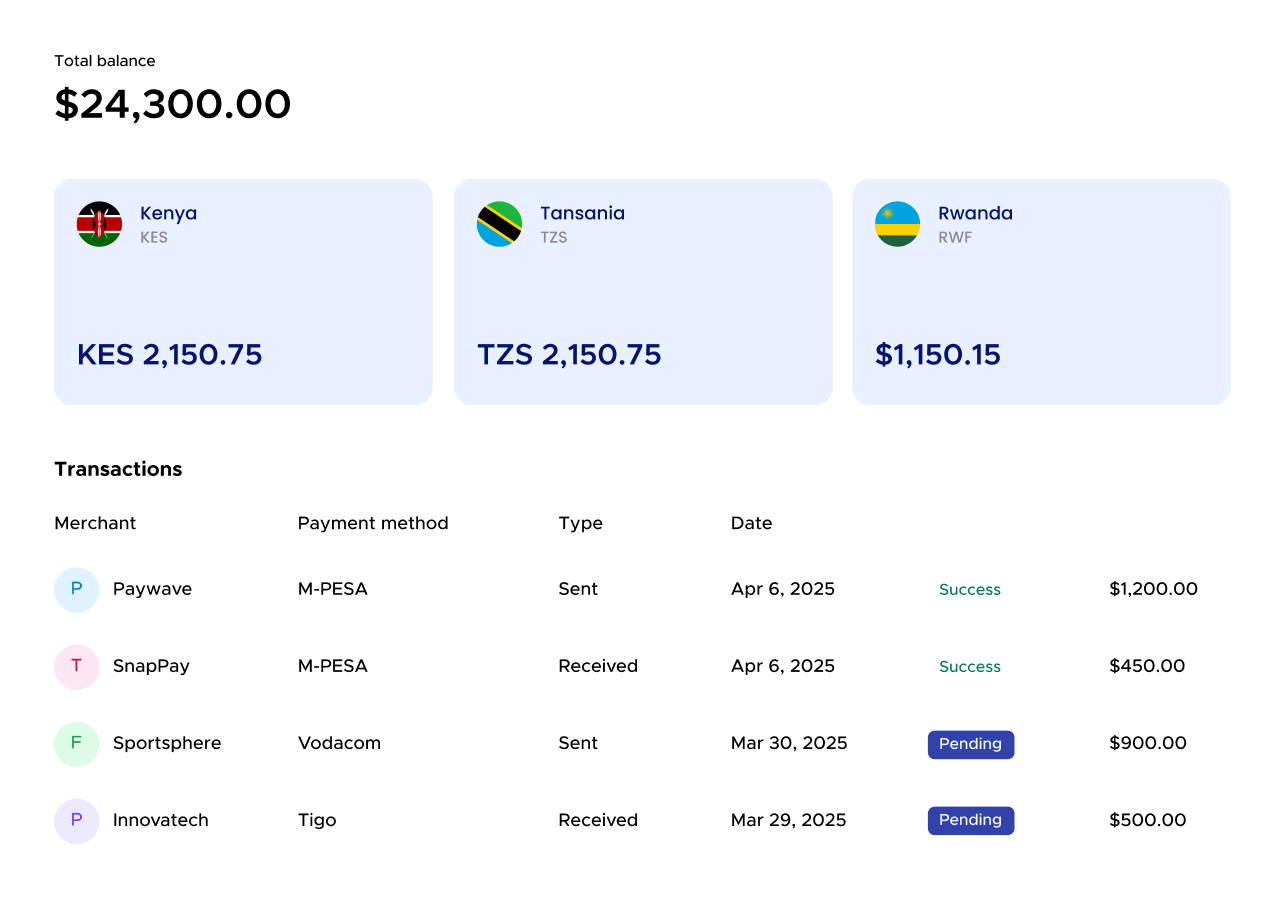

- Track transactions in real time and manage risks.

- Rely on us for tech, merchant support, and reconciliation.

- Add revenue, clients, and regions into your existing tech.

- Join a network to grow merchants and volumes.

- Enter new markets faster, with lower cost.